Theme

The technology war between the US and China has taken a new turn as the two countries’ race to subsidise their industries gathers pace. The lack of an ambitious response and flexible business support measures from the EU could have serious consequences for European competitiveness and industrial development.

Summary

This paper analyses the economic and political causes and developments in the technology war between the US and China, which began in 2015 and continues to escalate. The Biden Administration has complemented export control measures with a drive to maximise the technological distance between the two competitors through large-scale incentives in the form of subsidies and tax breaks. However, these introduce dangerous imbalances into the global playing field, with the potential to affect other actors such as the EU.

Analysis

The most important trade war in the last few years has not been the tariff war initiated by Trump. In contrast to what some might think, it has been the technology war between the US and China, which began at the end of the Obama era, gathered pace during the Trump presidency and has further escalated under the Biden Administration. The war has two aspects: first, to stop China catching up with US technological supremacy (with all the associated economic and military implications) by blocking technology transfer; and, secondly, to maximise the technological distance between the US and China, subsidising national production. This latter aspect has major consequences for the EU, with the potential to create a dangerous lag in technology.

Semiconductors and their value chain

The current situation can be largely explained by the technological importance of semiconductors and their value chain.

Semiconductors are materials that can act as conductors (allowing current to pass through) or insulators (preventing its passage), depending on a number of circumstances (eg, temperature, pressure, radiation or magnetic fields). This binary function makes them extremely useful for the electronics and IT industries.

They can be classified into two types, depending on their purity: intrinsic or pure; and extrinsic or ‘doped’. The former include silicon (the most widely used semiconductor, since it is the most commonly found in nature and behaves best at high temperatures), germanium, tin, selenium and tellurium. The second are pure semiconductors to which impurities are added to increase conductivity.

Semiconductors are used in the manufacture of a range of products, primarily transistors (amplifiers, switches, oscillators and rectifiers for electrical signals, used in radios, watches and lights), diodes (crystals that only allow electrical current to flow in one direction, used to convert AC to DC in solar panels or for LED lights) and chips (processors and memory for computers, tablets and mobile devices). This last category is the most important.

A chip (also called a microchip or integrated circuit) is a set of electronic circuits superimposed on a small flat piece of silicon (the most commonly used material and the second most abundant material in Earth’s crust) called a wafer. There are two types of chips: logic chips, which process general information (central processing units or CPUs, the ‘brains’ of computers), graphical information (GPUs, also known as video cards), audio (APUs, audio cards) and neural information (NPUs, for deep learning and machine learning applications); and memory chips, which store dynamic random access information (DRAM, which is extremely fast but volatile) or permanent information (NAND Flash, slower but less volatile, such as USB sticks and SD cards). All these chips are used in a range of electronic devices, including phones, games consoles, cars and medical equipment. Chips classed as mature –more than 40 nanometres (nm)– are frequently used in industries such as the automotive industry. The most advanced chips are less than 16nm, with an average size of 10nm (although up to 3nm has been achieved).

The chip value chain is functionally and geographically complex. Global production is structured around five types of manufacturers:

- Basic developers, which focus on the initial design phase and include Cadence, Synopsis, CEVA and Lattice in the US, the German firm Mentor Graphics, and Arm in the UK (recently subject to a failed take-over by Nvidia).

- Advanced developers without factories (fabless manufacturing), which produce complex or specialised designs and outsource their manufacture. Examples include Qualcomm, Nvidia, AMD, Xillinks and Marvell in the US, MediaTek in Taiwan and HiSilicon in China (owned by Huawei).

- Pure manufacturers or foundries, which produce chips under contract for other companies. Examples include the Taiwanese firms TSMC (a technological leader) and UMC, Global Foundries in the US and SMIC in China. Foundries use advanced machinery (cutting, measurement, etc) from the US firms Applied Materials, Lam Research and KLA, the Dutch firm ASML and the Japanese companies Tokyo Electron, Nikon and Canon Tokki, in addition to materials like silicon wafers and photomasks produced by the Japanese firms Shin-Etsu, Sumco, JSR and Tokyo Onika.

- Assembly, testing and packaging (ATP) firms, which are responsible for the final phase of the product. Examples include ASE Technology and Powertech in Taiwan, the Chinese companies JCET and UTAC, and the US firm Amkor.

- Integrated Device Manufacturers (IDMs), which perform all the above functions within the same corporate group. Examples include the US firms Intel, Infineon and Texas Instruments, and Samsung and SK Hynix in Korea. Some also provide foundry services for other companies.

The geographic distribution of the semiconductor value chain is shown in Figure 1. The significant relative weighting of the US compared to the EU is clear.

Figure 1. Geographic distribution of the semiconductor value chain (market share by country in each phase)

Figure 2 shows the main companies by market share as of 2021. Samsung and Intel make up a quarter of the IDMs and fabless market, while TSMC makes up over half of the foundry market.

Figure 2. Leading semiconductor manufacturers (market share 2021)

| Producers (excluding foundries) | % | Foundries | % |

|---|---|---|---|

| Samsung (South Korea) | 12.3 | TSMC (Taiwan) | 56.6 |

| Intel (US) | 12.2 | Samsung Foundry (South Korea) | 8.5 |

| SK Hynix (South Korea) | 6.1 | UMC (Taiwan) | 7.6 |

| Micron Technology (US) | 4.8 | GlobalFoundries (US) | 6.6 |

| Qualcomm (US) | 4.6 | SMIC (China) | 5.4 |

| Nvidia (US) | 3.2 | PSMC (China) | 2.3 |

| Broadcom Limited (US) | 3.0 | HH Grace (China) | 1.6 |

| MediaTek (Taiwan) | 2.9 | Vanguard (Taiwan) | 1.6 |

| Texas Instruments (US) | 2.8 | Tower Semiconductor (US) | 1.5 |

| AMD (US) | 2.7 | HLMC (China) | 1.3 |

| Others | 45.4 | Others | 7.0 |

The origin of the war: Made in China 2025

The technology war between the US and China has two interrelated causes, the first economic, the second political. The economic dimension stems from China’s desire to build its industrial capacity and work its way up the value-added ladder, an approach clearly set out in its Made in China 2025 industrial strategy and policy. Unveiled in May 2015 as part of the 13th and 14th five-year plans, the document’s vision is for China to move beyond being the ‘world’s factory’, a status the country has earned thanks to its low labour costs and the manufacture of technology-intensive goods. China’s Dual Circulation Strategy (2020) complements this idea of a more economically and technologically independent China and seeks to prioritise internal demand as a driver of growth (albeit without the country turning its back on its export strategy).

What makes this attempt at technological development concerning is that the new approach has gone hand-in-hand with a more assertive and even coercive approach to foreign policy. In a major speech delivered at the Hudson Institute on 4 October 2018, Mike Pence (Vice-President under the Trump Administration) clarified the US stance: China’s intentions (neither peaceful nor productive) make any industrial leadership even more dangerous, since ultimately this translates into military leadership.

For China, technological autonomy means above all self-sufficiency in the manufacture of semiconductors, of which the country is currently the largest global consumer (40% of global sales in 2021).

Semiconductors are also the country’s biggest import (US$33 billion a year, even greater than oil). Made in China 2025 set a target of meeting 40% of consumption by 2020 and 70% by 2025. Over US$50 billion of funds are earmarked for investment (generally controlled by the State) at the national and local levels, alongside tax incentives, low-interest loans and legal measures to incentivise local production of technology or its acquisition abroad.

Despite all this investment, China remains far from achieving its objectives: its market share of the top tiers of the value chain (eg, manufacturing and design) has hardly changed (except perhaps for memory chips). Nonetheless, the country maintains its strength on ATP (where the firm JCET enjoys a 14% market share).

Obama-era sanctions

It is often believed the technology war began under the Trump Administration. However, its roots go back to the Obama presidency, at least to 2010, when the US awoke from its dream of an increasingly democratic China steadily integrating into global economic and political governance. Xi Jinping’s rise to power in November 2012 was seen as further proof China that was moving towards strong leadership.

In this context, in 2015 the Bureau of Industry and Security of the US Department of Commerce, which is responsible for export controls, launched an investigation into ZTE, a large Chinese telecommunications firm that acted as an intermediary in the procurement of US technology that was being re-routed to Iran and North Korea to evade sanctions. In March 2016 ZTE was added to the US Entity List, a list of companies classed as receiving sensitive US goods.

New sanctions under Trump

ZTE’s US$900 million fine for failing to comply with sanctions on Iran and North Korea was handed down in March 2017, shortly after Donald Trump entered the White House. Despite his many differences with the previous Administration, Trump shared a distrust of China (which he blamed for stealing thousands of US jobs). Investigations were launched into Chinese companies and very soon another telecommunications giant was in the crosshairs: Huawei. This time, the problem was not only the evasion of sanctions but also the company’s dominance of the 5G ecosystem (on which the US lagged behind China and Europe). The technology, which provides the low latency needed for applications such as autonomous vehicles and telehealth, also has major national security implications for communications. While Huawei is perhaps most famous for its phones, it also manufactures 5G telecommunications equipment (base stations and towers). Moreover, despite being a private company, there is little doubt that, if summoned under article 7 of China’s National Intelligence Law, it would comply with any Government requests to intercept communications (this point is particularly important when dealing with technology that requires the constant installation of security patches).

As Huawei telecommunications equipment required US semiconductors, the company was added to the Entity List in May 2019. However, the measure did not deliver the expected results: the US Administration soon realised that the only semiconductors it had managed to control were direct exports from the US, which make up a fraction of global production (many chips designed by US companies are manufactured in foundries in Taiwan and South Korea).

The problem is that even though there are international agreements to control trade in dual use goods (civil and military) and despite the potential for the use of semiconductors for telecommunications devices in cyber warfare (or as an instrument of coercion due to their role in key infrastructure), they are classed as commercial goods and countries do not often subject them to export control. By prohibiting their export without altering the global supply chain, the US was actually harming the competitiveness of its own companies. To remedy this situation, in August 2020 the country resorted to an indirect route: the Foreign-Produced Direct Product rule, which subjects the overseas manufacture of semiconductors using US devices to licences. As US devices are used by the majority of the world’s foundries, the rule effectively allowed the US to control all semiconductors destined for Huawei regardless of where they were made. Fearful of losing the right to use US technology, the main global manufacturers fell in line and limited themselves to selling 4G chips to Huawei (licences for 5G technology were consistently denied).

However, the measure had an undesired side effect: at the height of the pandemic, when many plants were closed due to lockdowns, many companies, fearful of being sanctioned, began stockpiling semiconductors on a large-scale, aggravating scarcity and causing prices to rise sharply.

In parallel, China’s military and civil sectors became further intertwined. Chinese companies were encouraged to provide technology for the Chinese army, blurring the already murky boundary between the civil and military use of semiconductors.

This resulted in the approval of a third package of export control measures in 2020, this time centred on SMIC, one of the largest manufacturers in the world (located in Shanghai). The idea was to prevent SMIC using US technology to manufacture advanced chips that could find their way into the hands of the Chinese army.

The technology war under the Biden Administration

While formally much changed with Biden’s arrival in the White House, structurally this is not the case. Those who believed the new Administration would end Trump’s tariff protectionism and the sanctions on China have been proved wrong.

Two pivotal events occurred in the summer of 2022: the first was the news that, despite being included on the Entity List, SMIC had successfully produced a highly-advanced-node chip (7nm); the second was the controversial visit to Taiwan by the Speaker of the US House of Representatives, Nancy Pelosi, to which China responded with a major military reaction, generating serious concerns. The events dispelled any doubts regarding China’s national security implications for the US. From autumn 2022 anything that could facilitate the development of advanced-node semiconductors in China, advanced software or supercomputers was to be considered a national security threat for the US.

On 16 September 2022, Biden’s National Security Adviser, Jake Sullivan, delivered a major speech that changed the national security objectives of export controls. While the old objective was to maintain a ‘relative’ advantage over competitors for certain key technologies (using a ‘sliding scale’ approach to stay a few generations ahead), in the new geopolitical context the objective became to maintain ‘as large of a lead as possible’. In a multipolar world, the sliding scale, designed for the gradual liberalisation of controls on technologies as they become mass-market consumer goods (eg, GPS or encryption for mobile phones) is not enough: instead, it is necessary to stay far ahead of competitors, whatever the cost.

In practical terms, this speech translated into the measures unveiled on 7 October 2022, limiting the manufacture of four strategic products in China: advanced-node semiconductors; semiconductor manufacturing equipment (of any type); advanced computing capacity; and supercomputers. The overarching idea is that US companies and individuals should not contribute in any way to the development of these products by Chinese facilities.

Figure 3. Timeline of US technology sanctions on China

| Measures | Companies affected | Scope |

| March 2017 | ZTE | Sanctions |

| August 2018 | Huawei and ZTE | Prohibition of the use of products by the Government |

| May 2019 | Huawei and affiliates | Added to the Entity List |

| August 2020 | Huawei and affiliates | Foreign-Produced Direct Product rule: prior licence for the use of US machinery to produce advanced chips ( |

| September 2020 | SMIC | Classed as a military company controlled by the Chinese Communist Party. Prior licence for the supply of technology |

| December 2020 | SMIC and affiliates | Added to the Entity List Prohibition of investment in SMIC |

| October 2022 | All types of companies | Prior licence for the use of US technology for manufacturing advanced-node semiconductors, semiconductor manufacturing equipment, advanced computing capacity and supercomputers in China Not only US companies but also US citizens forbidden from aiding the manufacture of these products |

The measures of October 2022 (which set a one-year transition period for foreign multinationals that manufacture chips in China, eg, TSMC, Samsung, SK Hynix and Intel) means the Chinese plants can only use US technology to produce mature-node semiconductors (>14-16nm). Licences are provided for individual facilities, not for companies (this means the same company can have one plant authorised and another that is not; while this can make it possible to evade sanctions, the alternative of prohibiting all types of semiconductors could have caused a major shock to the global automotive industry, given the scarcity of mature chips). In addition to chips, the measures also cover advanced computing capacity and supercomputers. Lastly, there is the development of artificial intelligence, which, in addition to data, algorithms and memory, requires people, explaining why the sanctions also prohibit collaboration not only with US companies but also US citizens.

Despite their extraterritorial reach, the sanctions are nonetheless unilateral, which will reduce their long-term effectiveness (as the value chain readjusts). This is why the Biden Administration is currently trying to convince other governments to join it, including countries whose companies could provide alternatives to US technologies (such as the Netherlands and Japan, both of which manufacture machinery and with which an agreement was struck in January 2023). Another example is the Chip 4 Alliance proposal with Japan, Taiwan and South Korea.

The incentives: the Inflation Reduction Act and the CHIPS Act

Having defined national security as maintaining ‘as large a lead as possible’ over its direct competitor, it is not enough for the US to obstruct production using export controls (as the progress made by SMIC clearly shows). Major investment in technology is also required. This part of the equation is addressed by the Inflation Reduction Act (more focused on the energy transition but with support for research) and, more specifically, the CHIPS and Science Act (August 2022), which expressly acknowledges the objective of maintaining a competitive edge in science and technology in the industries of the future, including nanotechnology, clean energy, quantum computing and artificial intelligence.

The Inflation Reduction Act includes major tax incentives for R&D, in many cases linked to semiconductors.

The CHIPS Act (Creating Helpful Incentives to Produce Semiconductors) earmarks US$52.7 billion for US semiconductor development, with US$39 billion for manufacturing incentives (including US$2 billion for mature chips for the automotive and defence industries), US$13.2 billion for R&D and training, US$500 million for communications security and strengthening the value chain of inputs and a 25% tax break on investment.

The US, which is responsible for around 10% of global semiconductor production but none of the most advanced chips, is determined to become a world leader.

The reaction from China and other countries

The measures adopted by the US have proved controversial around the world. From a legal perspective, on 15 December 2022 China initiated a WTO dispute complaint on the US sanctions (since they involve export restrictions that are not necessarily compatible with the WTO). In terms of the subsidies under the CHIPS Act, while the WTO allows general R&D subsidies, links to specific sectors or national production are often incompatible. However, the issue seems unlikely to make much progress, not least because the US has made it clear (as a result of the WTO resolution in December 2022) that it will not allow any organisation to define what constitutes ‘national security’.

Multilateral issues aside, it is clear that China and the US have accelerated a dangerous subsidy race with unpredictable consequences.

In this context, it is not surprising that other countries have also begun to support their industries in recent years, regardless of any US cooperation. In May 2022 Japan agreed to set up a working group with the US on next-generation semiconductors, with mutual investment and the creation of a joint research centre. In May 2021 South Korea unveiled its plans for US$450 billion of investment up to 2030 and, in June 2020, Taiwan announced an annual US$1.3 billion fund to attract foreign investment into the sector, subsidising up to half of all R&D costs.

Lastly, in December 2022, China announced a support package for its semiconductor industry worth over US$143 billion, which takes the form of tax incentives spread over five years, alongside subsidies for production and research.

The effects of the technology war on the EU

As on other occasions, the disputes between the US and China have caught the EU off guard. On this side of the Atlantic, the debate has been firmly centred on China’s participation in the development of 5G technology (where, for once, the EU led the US). However, it did not expect the US to embark on a major round of investment subsidies.

The EU, which makes up less than 10% of global semiconductor manufacturing, has been unable to reduce its dependence (the European Commission has acknowledged that the strategy launched in 2013 failed). Production is concentrated in Germany, France, Italy, the Netherlands, Austria, Belgium and Ireland. The EU only enjoys a position of strength in the segments of basic intellectual property blocks and manufacturing tools, lagging far behind in other value-added segments. Initiatives under the Important Projects of Common European Interest programme have largely failed to deliver results, despite some efforts in the field of microelectronics.

In February 2022 the European Commission proposed its own Chips Act, promising to mobilise over €43 billion to double the EU’s share of semiconductor production (rising from the current figure of 10% to 20%). The drive is centred around three priorities: building capacity in technology and innovation; security of supplies; and monitoring and crisis response measures.

Yet, once again, despite the need for an urgent response to the US measures (to avoid the flight of companies across the Atlantic), it appears that Member States are not brave enough to accept the need to finance European public goods, never mind grasping the nettle of agreements to the state aid system. The Dutch Government has already rejected the use of public funds. The results are all too predictable: an underprovision of these public goods; and European investment that is tied to relative fiscal balances and debt levels and thus insufficient.

However, the EU needs to understand that the approval of finance and subsidies, which are needed to make progress on the value chain, is not enough to ensure success.

China’s enormous investment since 2015 shows it is not always easy to develop cutting-edge segments. Nor have giants like Intel and Samsung –despite all the money spent– been able to catch up with TSMC, which has maintained its position of leadership.

Moreover, the experience of Next Generation EU shows there are structural delays in allocating EU funds, and this can be critical in a key sector like semiconductors (in contrast to the US, where credits are practically automatic).

Conclusions

The EU faces an inevitable challenge: respond clearly to US measures, accepting that knowledge and cutting-edge technology are a European public good that is a prerequisite for future growth and competitiveness. Strategic autonomy, which does not only depend on the technology war but also on the role of other actors involved in the supply of essential raw materials, cannot be allowed to become a meaningless concept. Nor is it logical to focus on sterile debates on prioritising the disciplining of national finances before or after taking on joint projects. The debate on state aid and European financing of innovation (either through a European sovereign fund, as suggested by the President of the European Commission, or by other means) is urgent and can no longer be postponed.

Semiconductors are the cornerstone of industrial and technology policy in the 21st century (including artificial intelligence). If the EU does not wake up and accept the time has come to take risks (albeit with the necessary conditions) and simplify rules, it will be condemned to a dangerous strategic dependency over the next few decades.

The author would like to thank Mario Esteban, Raquel Jorge, Miguel Otero and Federico Steinberg for their comments.

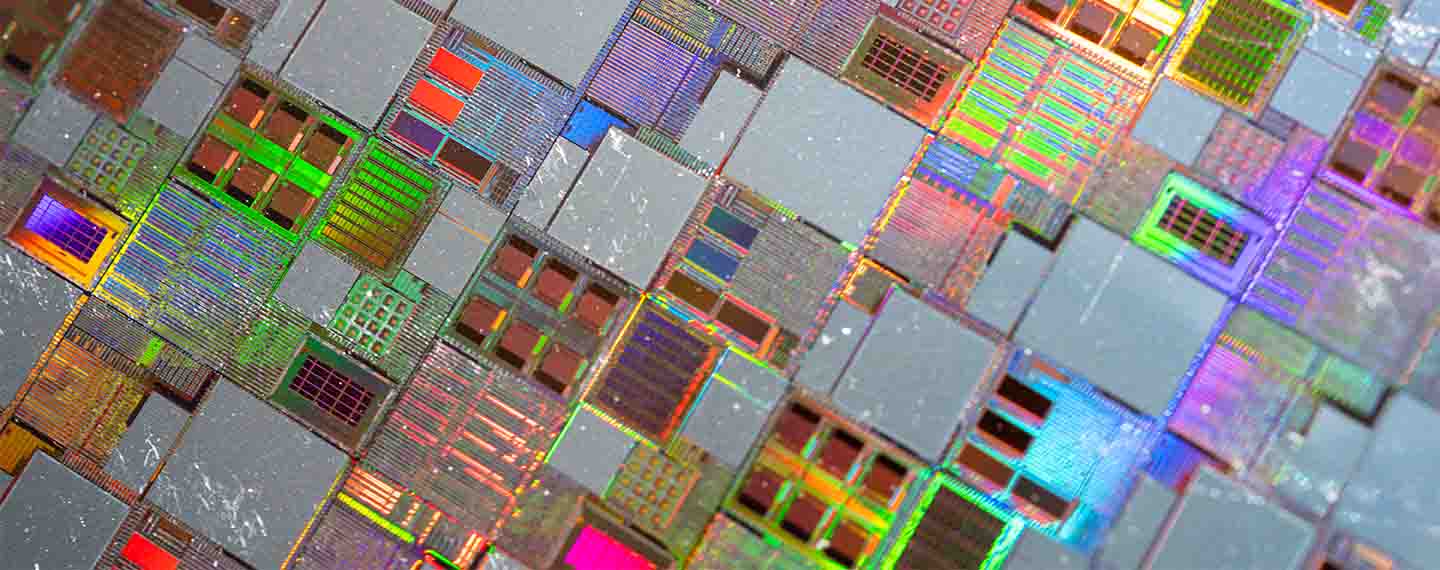

Image: Silicon foil for semiconductor fabrication of integrated circuits. Photo: Chormail.